Capital increase

Carry out capital increases with dCompany

Start with the target and indicate that you want to make a “capital increase” (share issue). The document robot takes care of all notices, minutes, shareholder register, articles of association, subscription forms and submission to the Brønnøysund Register Office.

Preference issue

Shareholders will have preferential rights to subscribe for the shares that are issued. If not pre-arranged, shareholders must be given a subscription period of two weeks to decide whether to subscribe for shares.

Directed issue

Shareholders do not have preferential rights, the capital increase is made against specific named persons. The company normally knows who will subscribe and how many shares each individual will subscribe for, which means that the subscription process can be simplified.

Fund issue

Profits are converted to share capital. This strengthens the share capital without injecting new funds, either by issuing new shares or by increasing the nominal value.

How a private placement works

When you create a capital increase project in dBot, you will be asked a number of questions and guided through all the steps necessary to complete the capital increase. Here you can see how a private placement works.

We help you with board meetings, general meetings, subscription, allocation, confirmation, and registration in the Register of Business Enterprises and the shareholder register and articles of association.

The platform supports all forms of share deposits, i.e. cash deposits, conversion of debts and deposits in kind. You can easily check that the funds from a cash contribution can be used before the capital increase is registered in the Brønnøysund Registers if you wish.

The platform supports the issuance of shares in all share classes

Open the document robot and select Capital increase

Tell us what kind of capital increase you want

You answer the questions asked, including whether the capital increase is to be resolved by the general meeting or whether it is to be resolved by the board of directors pursuant to an authorization from the general meeting.

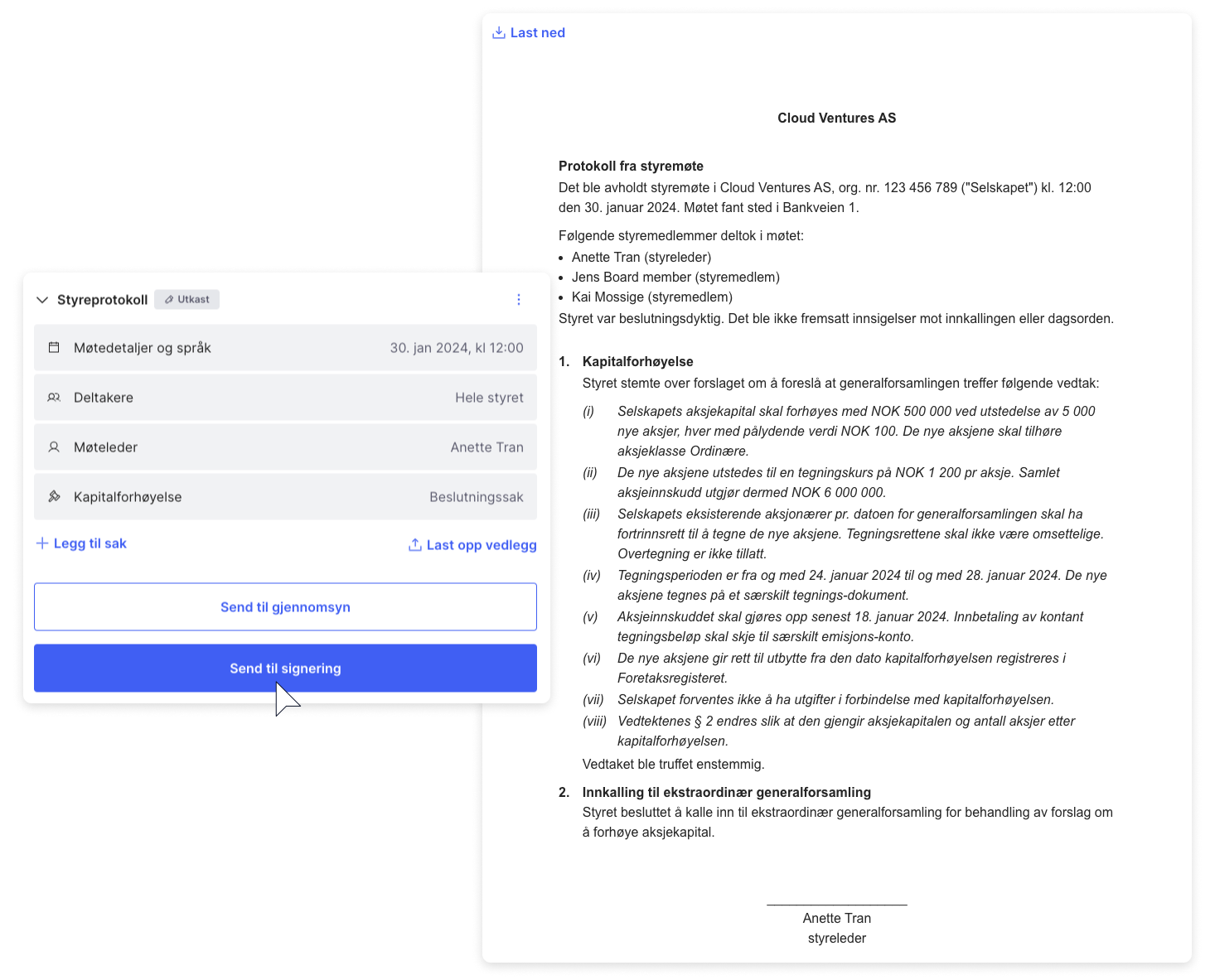

All the documents you need are generated automatically

dBot automatically creates the documents necessary to carry out the capital increase.

.. and all the tools you will eventually need

Electronic subscription form, allocation and registration in the Register of Business Enterprises and shareholder book and articles of association

Conduct the board meeting or send the minutes directly for signing

User-friendly digital signing at the highest security level. Send protocols for signing quickly and easily. dCompany allows you to sign quickly and easily with Norwegian or Swedish BankID or by other means.

Convene a general meeting

dBot has automatically created a notice of general meeting. You can easily send it out through the platform.

Conduct general meeting

The general meeting makes the decision to increase the share capital if it has not been made by the board of directors pursuant to an authorization from the general meeting. The general meeting may only resolve to issue shares against specifically named subscribers, i.e. that who can subscribe for the shares must be clarified at this time.

Send general meeting minutes for signing

dBot automatically creates the necessary general meeting minutes. Once the general meeting has been held, you can send the minutes for signing through the platform.

Send out subscription forms

It is not sufficient that the company has decided to issue shares. The shares must also be subscribed for by the persons who have been offered to subscribe for the shares by resolution of the general meeting. This subscription can either be made in the minutes of the general meeting or on a separate subscription form sent out through the platform.

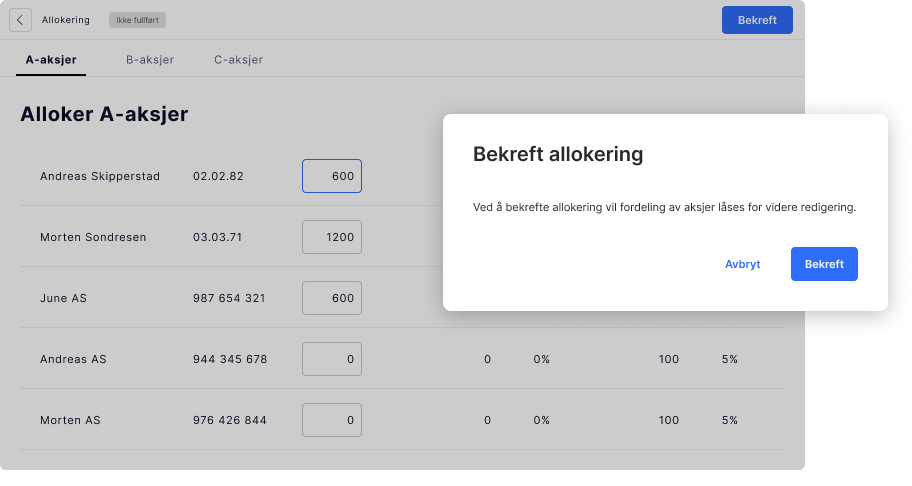

Allocate shares

As soon as the subscription has been made, the company can confirm the allocation of shares to those who have subscribed. In a private placement, it is normally clear how many shares each individual will subscribe for, and the allocation process is therefore simple.

Register paid-up capital

As soon as the allocation has been made, the company may request payment of the share contribution.

Upload confirmation from the auditor

If the share contribution is to be paid in cash in Norwegian kroner, the contribution can be confirmed by an auditor, state-authorized accountant, bank or lawyer. Other forms of share contributions can only be confirmed by the auditor.

In the case of deposits other than cash, the auditor must also confirm the statements made for the deposit.

Report the capital increase to brreg

Once the share contribution has been paid and the necessary confirmations have been submitted, you can report the capital increase to the Register of Business Enterprises directly from the platform.

Update shareholder register and articles of association

Once the capital increase is registered, you can update the shareholder book and articles of association by selecting to register the capital increase on the dCompany platform. According to the Limited Liability Companies Act, the capital increase is only considered completed at this time.

If shareholder rights have been granted at an earlier point in time, for example by subscription, registration on the dCompany platform can already take place at that earlier point in time.

Automate more

company events

Combine events

With dBot you can combine free text and automated company events in the same formal process

Norwegian and English

Choose between Norwegian, English or bilingual documents

Become one of our

satisfied customers

Fantastic product with great utility. Carried out a share split quickly and easily. The digital shareholder book is very useful for me vis-à-vis all the portfolio companies.

Erik Rian Johannessen

CFO

Longship